VARMAX models¶

This is a brief introduction notebook to VARMAX models in statsmodels. The VARMAX model is generically specified as:

where \(y_t\) is a \(\text{k_endog} \times 1\) vector.

[1]:

%matplotlib inline

[2]:

import numpy as np

import pandas as pd

import statsmodels.api as sm

import matplotlib.pyplot as plt

[3]:

dta = sm.datasets.webuse('lutkepohl2', 'https://www.stata-press.com/data/r12/')

dta.index = dta.qtr

endog = dta.loc['1960-04-01':'1978-10-01', ['dln_inv', 'dln_inc', 'dln_consump']]

Model specification¶

The VARMAX class in statsmodels allows estimation of VAR, VMA, and VARMA models (through the order argument), optionally with a constant term (via the trend argument). Exogenous regressors may also be included (as usual in statsmodels, by the exog argument), and in this way a time trend may be added. Finally, the class allows measurement error (via the measurement_error argument) and allows specifying either a diagonal or unstructured innovation covariance matrix (via the

error_cov_type argument).

Example 1: VAR¶

Below is a simple VARX(2) model in two endogenous variables and an exogenous series, but no constant term. Notice that we needed to allow for more iterations than the default (which is maxiter=50) in order for the likelihood estimation to converge. This is not unusual in VAR models which have to estimate a large number of parameters, often on a relatively small number of time series: this model, for example, estimates 27 parameters off of 75 observations of 3 variables.

[4]:

exog = endog['dln_consump']

mod = sm.tsa.VARMAX(endog[['dln_inv', 'dln_inc']], order=(2,0), trend='n', exog=exog)

res = mod.fit(maxiter=1000, disp=False)

print(res.summary())

/home/travis/build/statsmodels/statsmodels/statsmodels/tsa/base/tsa_model.py:162: ValueWarning: No frequency information was provided, so inferred frequency QS-OCT will be used.

% freq, ValueWarning)

Statespace Model Results

==================================================================================

Dep. Variable: ['dln_inv', 'dln_inc'] No. Observations: 75

Model: VARX(2) Log Likelihood 361.038

Date: Tue, 17 Dec 2019 AIC -696.077

Time: 23:39:38 BIC -665.949

Sample: 04-01-1960 HQIC -684.047

- 10-01-1978

Covariance Type: opg

===================================================================================

Ljung-Box (Q): 61.24, 39.25 Jarque-Bera (JB): 11.14, 2.41

Prob(Q): 0.02, 0.50 Prob(JB): 0.00, 0.30

Heteroskedasticity (H): 0.45, 0.40 Skew: 0.16, -0.38

Prob(H) (two-sided): 0.05, 0.03 Kurtosis: 4.86, 3.44

Results for equation dln_inv

====================================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------------

L1.dln_inv -0.2388 0.093 -2.564 0.010 -0.421 -0.056

L1.dln_inc 0.2861 0.450 0.636 0.525 -0.595 1.167

L2.dln_inv -0.1665 0.155 -1.072 0.284 -0.471 0.138

L2.dln_inc 0.0628 0.421 0.149 0.881 -0.762 0.888

beta.dln_consump 0.9750 0.638 1.528 0.127 -0.276 2.226

Results for equation dln_inc

====================================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------------

L1.dln_inv 0.0633 0.036 1.773 0.076 -0.007 0.133

L1.dln_inc 0.0811 0.107 0.758 0.448 -0.129 0.291

L2.dln_inv 0.0104 0.033 0.315 0.753 -0.054 0.075

L2.dln_inc 0.0350 0.134 0.261 0.794 -0.228 0.298

beta.dln_consump 0.7731 0.112 6.879 0.000 0.553 0.993

Error covariance matrix

============================================================================================

coef std err z P>|z| [0.025 0.975]

--------------------------------------------------------------------------------------------

sqrt.var.dln_inv 0.0434 0.004 12.284 0.000 0.036 0.050

sqrt.cov.dln_inv.dln_inc 5.58e-05 0.002 0.028 0.978 -0.004 0.004

sqrt.var.dln_inc 0.0109 0.001 11.222 0.000 0.009 0.013

============================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

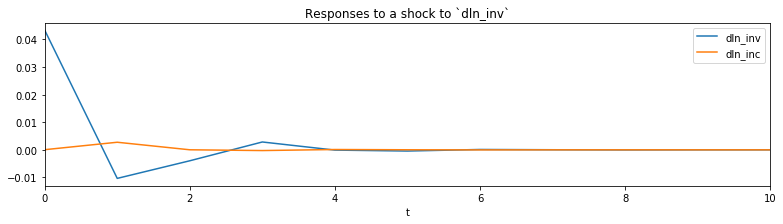

From the estimated VAR model, we can plot the impulse response functions of the endogenous variables.

[5]:

ax = res.impulse_responses(10, orthogonalized=True).plot(figsize=(13,3))

ax.set(xlabel='t', title='Responses to a shock to `dln_inv`');

Example 2: VMA¶

A vector moving average model can also be formulated. Below we show a VMA(2) on the same data, but where the innovations to the process are uncorrelated. In this example we leave out the exogenous regressor but now include the constant term.

[6]:

mod = sm.tsa.VARMAX(endog[['dln_inv', 'dln_inc']], order=(0,2), error_cov_type='diagonal')

res = mod.fit(maxiter=1000, disp=False)

print(res.summary())

/home/travis/build/statsmodels/statsmodels/statsmodels/tsa/base/tsa_model.py:162: ValueWarning: No frequency information was provided, so inferred frequency QS-OCT will be used.

% freq, ValueWarning)

Statespace Model Results

==================================================================================

Dep. Variable: ['dln_inv', 'dln_inc'] No. Observations: 75

Model: VMA(2) Log Likelihood 353.887

+ intercept AIC -683.774

Date: Tue, 17 Dec 2019 BIC -655.964

Time: 23:39:43 HQIC -672.670

Sample: 04-01-1960

- 10-01-1978

Covariance Type: opg

===================================================================================

Ljung-Box (Q): 68.61, 39.33 Jarque-Bera (JB): 12.77, 13.96

Prob(Q): 0.00, 0.50 Prob(JB): 0.00, 0.00

Heteroskedasticity (H): 0.44, 0.81 Skew: 0.06, -0.49

Prob(H) (two-sided): 0.04, 0.59 Kurtosis: 5.02, 4.87

Results for equation dln_inv

=================================================================================

coef std err z P>|z| [0.025 0.975]

---------------------------------------------------------------------------------

intercept 0.0182 0.005 3.809 0.000 0.009 0.028

L1.e(dln_inv) -0.2576 0.106 -2.437 0.015 -0.465 -0.050

L1.e(dln_inc) 0.5044 0.629 0.802 0.422 -0.728 1.737

L2.e(dln_inv) 0.0286 0.149 0.192 0.848 -0.264 0.321

L2.e(dln_inc) 0.1951 0.475 0.410 0.682 -0.737 1.127

Results for equation dln_inc

=================================================================================

coef std err z P>|z| [0.025 0.975]

---------------------------------------------------------------------------------

intercept 0.0207 0.002 13.065 0.000 0.018 0.024

L1.e(dln_inv) 0.0477 0.042 1.145 0.252 -0.034 0.129

L1.e(dln_inc) -0.0709 0.141 -0.503 0.615 -0.347 0.205

L2.e(dln_inv) 0.0181 0.043 0.424 0.672 -0.065 0.102

L2.e(dln_inc) 0.1199 0.154 0.780 0.435 -0.181 0.421

Error covariance matrix

==================================================================================

coef std err z P>|z| [0.025 0.975]

----------------------------------------------------------------------------------

sigma2.dln_inv 0.0020 0.000 7.345 0.000 0.001 0.003

sigma2.dln_inc 0.0001 2.32e-05 5.840 0.000 9.01e-05 0.000

==================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

Caution: VARMA(p,q) specifications¶

Although the model allows estimating VARMA(p,q) specifications, these models are not identified without additional restrictions on the representation matrices, which are not built-in. For this reason, it is recommended that the user proceed with error (and indeed a warning is issued when these models are specified). Nonetheless, they may in some circumstances provide useful information.

[7]:

mod = sm.tsa.VARMAX(endog[['dln_inv', 'dln_inc']], order=(1,1))

res = mod.fit(maxiter=1000, disp=False)

print(res.summary())

/home/travis/build/statsmodels/statsmodels/statsmodels/tsa/statespace/varmax.py:163: EstimationWarning: Estimation of VARMA(p,q) models is not generically robust, due especially to identification issues.

EstimationWarning)

/home/travis/build/statsmodels/statsmodels/statsmodels/tsa/base/tsa_model.py:162: ValueWarning: No frequency information was provided, so inferred frequency QS-OCT will be used.

% freq, ValueWarning)

Statespace Model Results

==================================================================================

Dep. Variable: ['dln_inv', 'dln_inc'] No. Observations: 75

Model: VARMA(1,1) Log Likelihood 354.283

+ intercept AIC -682.567

Date: Tue, 17 Dec 2019 BIC -652.440

Time: 23:39:44 HQIC -670.537

Sample: 04-01-1960

- 10-01-1978

Covariance Type: opg

===================================================================================

Ljung-Box (Q): 68.77, 39.05 Jarque-Bera (JB): 10.77, 14.12

Prob(Q): 0.00, 0.51 Prob(JB): 0.00, 0.00

Heteroskedasticity (H): 0.43, 0.91 Skew: 0.00, -0.46

Prob(H) (two-sided): 0.04, 0.81 Kurtosis: 4.86, 4.92

Results for equation dln_inv

=================================================================================

coef std err z P>|z| [0.025 0.975]

---------------------------------------------------------------------------------

intercept 0.0110 0.068 0.161 0.872 -0.122 0.144

L1.dln_inv -0.0097 0.718 -0.013 0.989 -1.417 1.397

L1.dln_inc 0.3620 2.847 0.127 0.899 -5.218 5.942

L1.e(dln_inv) -0.2502 0.729 -0.343 0.732 -1.680 1.180

L1.e(dln_inc) 0.1262 3.089 0.041 0.967 -5.929 6.181

Results for equation dln_inc

=================================================================================

coef std err z P>|z| [0.025 0.975]

---------------------------------------------------------------------------------

intercept 0.0166 0.029 0.580 0.562 -0.039 0.072

L1.dln_inv -0.0332 0.286 -0.116 0.908 -0.593 0.527

L1.dln_inc 0.2311 1.160 0.199 0.842 -2.042 2.505

L1.e(dln_inv) 0.0884 0.292 0.303 0.762 -0.484 0.661

L1.e(dln_inc) -0.2352 1.192 -0.197 0.844 -2.572 2.102

Error covariance matrix

============================================================================================

coef std err z P>|z| [0.025 0.975]

--------------------------------------------------------------------------------------------

sqrt.var.dln_inv 0.0449 0.003 14.535 0.000 0.039 0.051

sqrt.cov.dln_inv.dln_inc 0.0017 0.003 0.645 0.519 -0.003 0.007

sqrt.var.dln_inc 0.0116 0.001 11.667 0.000 0.010 0.013

============================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).